Introduction

Canagold’s core asset is the 100% owned, past-producing, high-grade, New Polaris gold project located in north-western British Columbia.

Location and Access

The New Polaris project is situated in northwestern British Columbia, 100 km south of Atlin, B.C., and 60 km northeast of Juneau, Alaska, on the west bank of the Tulsequah River near the B.C. - Alaska border.

Small aircraft carrying personal and/or supplies can reach the site from Atlin or Juneau. Heavier mine equipment and supplies can be barged to the minesite via the Taku River.

Ownership

Canagold holds a 100% interest in 61 crown granted mineral claims and 1 modified grid claim totaling 2,956 acres. The project is subject to a 15% net profits interest to Rembrandt Gold Mines, which can be reduced to 10% NPI for 150,000 shares.

Current Status

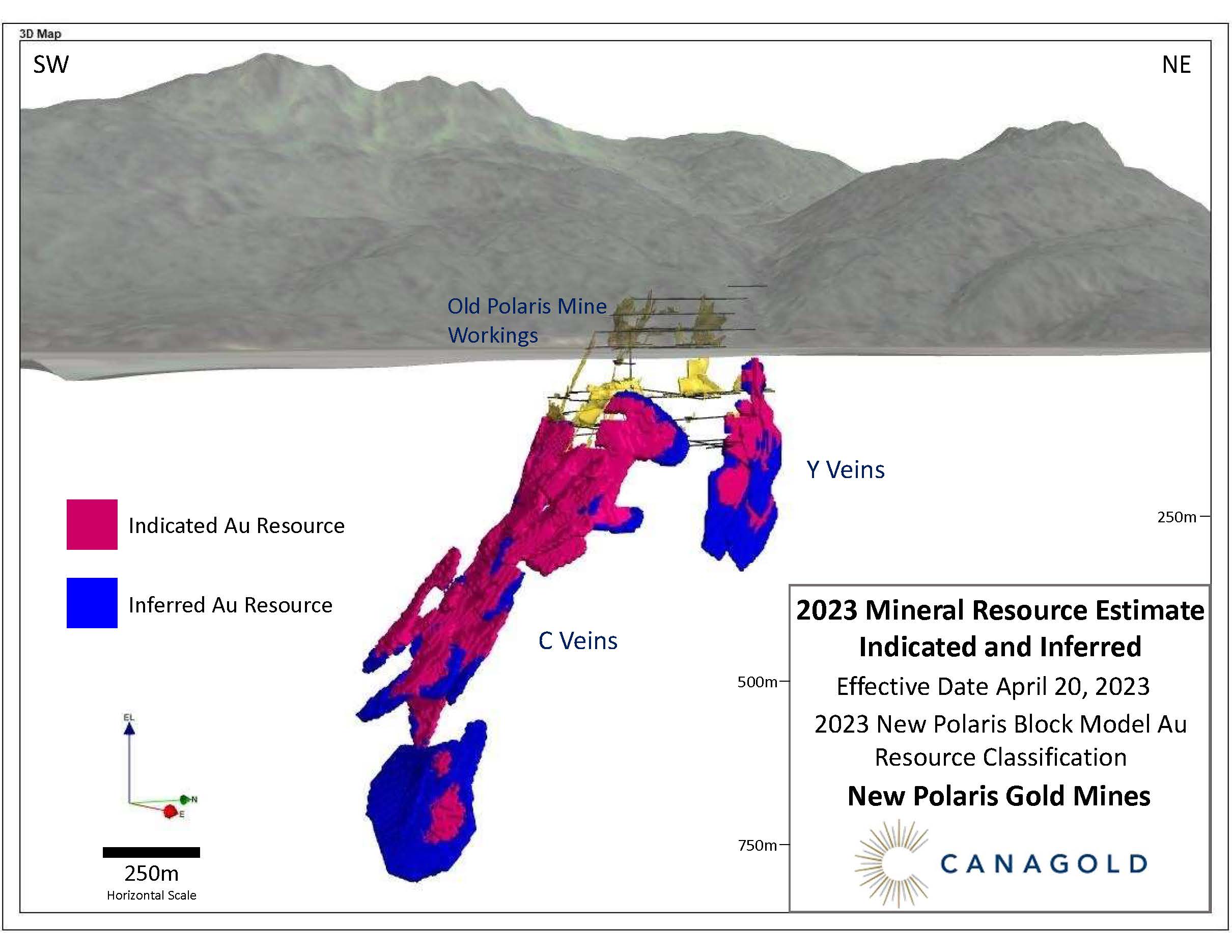

On May 16, 2023, Canagold announced an updated Mineral Resource Estimate (MRE) for New Polaris, tabled below. The MRE follows a 2021-2022 exploration campaign in which Canagold completed a 82-hole, 39,000-meter infill and resource expansion drilling program. The program was designed to upgrade inferred resources to indicated resources, contribute to mine and plant engineering, environmental permitting and work towards completing a feasibility study. The drill program concentrated on infill drilling and expansion of the C-West Main vein which hosts the bulk of the resources (below). Drilling in other parallel and adjacent zones, including the C9 and C10 zones and the near surface Y-Veins have also returned significant high-grade intercepts.

Highlighted intercepts include 24.2 gpt (grams per tonne) gold over 6.6 m ( metres) and 15.8 g/t gold over 13.0 m in the C-West Main vein, with deep holes extend mineralization 600 m to depths beyond 1000 metres.

Assays also returned 11.1 gpt Au over 17.8 m and 11 gpt over 8.9 m in the C-10 and C-9 veins, two separate hanging-wall veins adjacent to the C-West Main vein.

Results from the summer/fall 2022 program reported February 6, 2023, included 53.8 gpt Au over 2.78 m and 18.0 gpt Au over 5.64 m in Y-vein System

In October 2022, Canagold engaged Ausenco Engineering to complete a feasibility study.

On March 29, 2023 Canagold announced its Initial Project Description (IPD) and Engagement Plan submission to the B.C. Environmental Assessment Office on behalf of the New Polaris Project.

The IPD submission formally initiates the Early Engagement phase of the provincial assessment process. The IPD provides an overview and detailed description of the Company’s plans to develop, operate, and eventually decommission the New Polaris Gold Project.

Resource (NI 43-101 compliant)

New Polaris - Resource Estimate, effective date: April 20, 2023 and Comparison to 2019

| 2023 Resource | 2019 Resource | ||||||

| Class | Cutoff | Tonnage (ktonnes) | Au (gpt) | Au (koz) | Tonnage (ktonnes) | Au (gpt) | Au (koz) |

| (Au gpt) | |||||||

| Indicated | 3 | 3,118 | 11.21 | 1,124 | 1,798 | 10.40 | 601 |

| 4 | 2,965 | 11.61 | 1,107 | 1,687 | 10.80 | 586 | |

| 5 | 2,769 | 12.11 | 1,078 | 1,556 | 11.30 | 565 | |

| 6 | 2,525 | 12.75 | 1,035 | 1,403 | 12.00 | 541 | |

| 7 | 2,270 | 13.45 | 981 | 1,260 | 12.60 | 510 | |

| 8 | 2,049 | 14.09 | 928 | 1,105 | 13.30 | 473 | |

| 9 | 1,814 | 14.81 | 864 | 947 | 14.10 | 429 | |

| 10 | 1,594 | 15.55 | 797 | 1,639 | 9.50 | 501 | |

| Inferred | 3 | 1,061 | 8.24 | 281 | 1,582 | 9.80 | 498 |

| 4 | 926 | 8.93 | 266 | 1,483 | 10.20 | 486 | |

| 5 | 817 | 9.52 | 250 | 1,351 | 10.70 | 465 | |

| 6 | 706 | 10.16 | 231 | 1,223 | 11.20 | 440 | |

| 7 | 603 | 10.78 | 209 | 942 | 12.50 | 379 | |

| 8 | 491 | 11.52 | 182 | 753 | 13.80 | 334 | |

| 9 | 371 | 12.51 | 149 | 653 | 14.60 | 307 | |

| 10 | 291 | 13.33 | 125 | 0 | 0.00 | 0 | |

Notes to the Resource Table:

- Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the mineral resources will be converted into mineral reserves.

- Resources are reported using the 2014 CIM Definition Standards and were estimated using the 2019 CIM Best Practices Guidelines.

- The base case Mineral Resource has been confined by "reasonable prospects of eventual economic extraction" shape using the following assumptions:

- Metal prices of US$1,750/oz Au and Forex of 0.75 $US:$CDN;

- Payable metal of 99% Au;

- Offsite costs (refining, transport and insurance) of US$7/oz;

- Mining cost of CDN$82.78/t , Processing costs of CDN$105.00/t and G&A and site costs of CDN$66.00/t.

- Metallurgical Au recovery of 90.5%;

- NSR (CDN$/t)=Au*90.5%*US$74.72g/t;

- The specific gravity is 2.81 for the entire deposit;

- Numbers may not add due to rounding.

About the Mineral Resource Estimate

- A comprehensive statistical review of all available QA/QC assay data from the drilling was undertaken as part of the 2023 MRE.

- Interpolation was by inverse distance squared (“ID2”), which is a change from Ordinary kriging used in the 2019 PEA. However, variograms were created on a global basis to aid in determination of Classification parameters.

- Gold values were capped for each individual domain of the geological model based on statistical probability plots.

- The 2023 MRE is based on a 5 m block model using a Percentage Model (meaning that the percentage of the block within the domain is used for the MRE).

- A constant specific gravity of 2.81 g/cc is used for all blocks in the model, based on an average of measured sample SG’s.

- Indicated classification of a block required either 1) average distance to two drill holes of 35 m, maximum distance 50 m and minimum number of two quadrants, or 2) average distance to two drill holes of 50 m, maximum distance 70 m and minimum number of two quadrants, or 3) distance to closest drill hole of 10 m, maximum distance of 50 m used and minimum number of three drill holes used.

- The classification was checked for cohesiveness, with a cohesive shape of Indicated and Inferred material produced.

- The base case cutoff grade of 4 gpt Au is based on a US$1,750/ounce price of gold and preliminary recovery, processing and mining costs which are based on preliminary production rate values as summarized in the Notes to the resource table.

- The 2023 MRE table presents undiluted values of gold grade and contained gold ounces.

- The following factors, among others, could affect the 2023 MRE: assumptions used in generating confining shapes, stope design; mining methods; metal recoveries, mining and process cost assumptions and commodity price and exchange rate assumptions. The QP is not aware of any environmental, permitting, legal, title, taxation, socioeconomic, marketing, political, or other relevant factors that could materially affect the 2023 MRE.

The figure below illustrates a three-dimensional view of the previous underground workings, and the modelled vein shapes with the blocks illustrating the classification.

Figure 1: Classification of the Polaris Resource

Mining History

Prospectors discovered gold at New Polaris in 1929. The mine, then known as Polaris Taku, was built in 1937 and commissioned a year later. It operated until 1942, shut down due to World War II, and then restarted in 1946 and operated until 1951. In 1951, a barge loaded with gold concentrate sunk off of the coast of BC in a violent storm. As a result the mine closed. Cominco owned and operated the nearby Tulsequah Chief and Big Bull deposits and in 1952 leased the site Polaris-Taku site and upgrade the mill to process ores mined from these deposits. This continued until 1957. During the mines operation, a total of 232,000 oz. gold was produced from 691,000 tonnes of ore grading 11.9 grams per tonne (0.35 oz./ton). Gold concentrates were shipped to a smelter in Tacoma, Washington for refining. About 15,796 m of under-ground development on 10 levels, and 3,747 m of raise development were completed at New Polaris. The deepest level of the mine is 187 m below sea level. A 250 m internal winze was used to haul ore to the main haulage access level. Mining methods included long-hole, shrinkage and resuing.

New Polaris then lay dormant for 30 years until exploration resumed in 1988. Canagold acquired New Polaris in 1992 and since has drilled 241 holes totaling 64,000 m of core, outlining significant new ore below and beyond the old mine workings.

Geology and Gold Mineralization

Gold occurs in finely disseminated arsenopyrite that permeates the silica/sericite/fuchsite-altered wall rocks of almost barren quartz-carbonate veins. The white quartz-carbonate veins developed late in the mineralizing hydrothermal system and remobilized rare free gold into some late quartz/stibnite veins.

The mineralized veins are hosted within Paleozoic-aged mafic volcanic rocks and are developed along three principal vein sets adjacent to a major crustal break. Gold mineralization is late Cretaceous to Early Tertiary, and is very similar in terms of wall rock alteration, style of mineralization and host rock material to well-known Archean lode gold deposits such as Goldcorp's multi-million ounce Red Lake deposits.

Gold mineralization occurs along three major vein sets:

- AB shear veins - trending northwest/southeast,

- Y extension veins - trending north/south,

- C shear veins - trending east/west

C-veins generally link with the AB and with the Y veins at "junction arcs". Gold values within the veins show excellent continuity and uniformity, with very little nugget effect. Individual zones pinch, swell, and overlap en echelon. Width of gold mineralization ranges from 0.3 to 15 m in thickness, but tends to average about 3 m.

Metallurgy

Historically, the mine operated at a rate of 200 tons per day. Ore was crushed through primary and secondary crushers, and ground in a ball mill. A standard flotation circuit was used to concentrate the ore prior to being shipped off site. Historical gold recoveries averaged 90% and concentrate grades ranged from 3.5 - 5.0 oz per ton gold.

Recently Canagold performed metallurgical test work that utilized flotation, bio-oxidation of the flotation concentrate followed by CIL leaching and refining to produce gold dore bars at site. These tests achieved an average recovery of 90.5%. Additional metallurgical test work will be conducted during the feasibility stage to optimize the processing conditions.

Site Infrastructure

Several historic buildings have been refurbished and serve as both sleeping quarters and the kitchen facility during the most recent drilling campaigns in 2006. The historic machine shop has also been maintained as a maintenance facility.

Disclaimer

Cautionary Note to US Investors- The United States Securities and Exchange Commission limits disclosure for US reporting purposes to mineral deposits that a company can economically and legally extract or produce. We use certain terms on this web site, such as "reserves, " "resources," "geologic resources," "proven", "probable", "measured", "indicated," or "inferred," which may not be consistent with the reserve definitions established by the SEC. U.S investors are urged to consider closely the disclosure in our Form 20-F, File No. 000-18860. You can review and obtain copies of these filings from the SEC's website at www.sec.gov/edgar.shtml.

Garry Biles, P. Eng, President & COO for Canagold Resource Corp, is the Qualified Person who reviewed and approved the contents of this section.